Despite the dire risk of boring many readers, I've decided to blog up some investment advice.

The following is taken from a post by the mighty Ric at

"So how do I make money then?," a recent discussion thread at

Allstocks.com’s Bulletin Board.

PRICE IS CONTROLLED BY THE PSYCHOLOGICAL TRAPPINGS OF THE MARKET.By realityinc21/DianaStage 1 - Accumulation. Stock is quiet, trading sideways and without a lot of volatility. Most everyone ignores the stock because it has no sizzle. Insiders hold large blocks of stock and quietly gear up for the distribution.

Stage 2 - Breakout. Volume jumps up, psychological barriers are broken. Insiders begin to tell their friends of upcoming significant fundamental change. Pros take notice and buy the stock on the coat tails of the well informed. The public ignores it because they have not read about the company in the paper yet. It must be a scam.

Stage 3 - Uptrend. As a larger audience learns of the company and its promise, more buying comes in to the stock and it begins to climb. Pros begin to sell, but slowly. Average investor begins to buy.

Stage 4 - Pullback. The stock has gone up too fast, and some profit taking arrives. The jumpy investor who got the entry timing right but lacks confidence in his or her decision sells the stock with a small profit, and smiles in the mirror. The Pro holds on, Average Investor looks through the newspaper to find justification for ownership of the shares.

Stage 5 - Resumption of the Uptrend. The pull back is short lived, and the stock bounces and continues higher. The wannabe regrets the sell, but provides self counsel on the merit of making a profit, albeit a small one. The Pro might sell a little bit more, but still holds the majority of the original position. The Average Investor is getting excited now, and thinks about what could have been if only he had bought when he first noticed the stock.

Stage 6 - Exhaustion of the Uptrend. The media takes notice, and communicates the company's merits to the masses. The masses buy the stock, and it goes up sharply with strong volume. The Pros sell with enthusiasm. The Average Investor owns it now, and is telling everyone who will listen. The wannabe Pro jumps back on, after all, he was smart enough to buy it when the trend started, so he knows the stock well. Will hope make it go higher?

Stage 7 - Gravity Works. Pro selling begins to weigh on the uptrend, and the stock fails to go higher despite high volumes. The stock starts to go down instead of up, and the Pro is almost sold out. The Average Investor continues to cheer lead, hoping to rally support. The wannabe ignores what the market is telling him, taking a loss is too painful to consider. The company is featured on the cover of a magazine.

Stage 8 - The Second Guess. The stock bounces and starts to go back up. The wannabe Pro averages down while the Average Investor gets back to advising friends of his stock picking acumen. Pros sell their remaining holdings and begin to look for another deal to play, or perhaps start short selling the stock.

Stage 9 - Out of Gas. The bounce is a fake out, and the stock moves lower again. The public owns this stock, and they have no more power to buy. The Pro are making money on the short sales now, but are despised by the masses. The Average Investor makes calls for short selling to be made illegal—after all, the short sellers are the demons causing the sell off.

Stage 10 - Dead Cat Bounce. The Average Investor and the wannabe Pro have no pain tolerance left, and finally sell for a big loss. The short selling Pros are the only buyers to take the share off their hands, and provide the needed liquidity. The stock bounces, and some short-term traders make a quick profit. The Average Investor either swears to never buy a stock again, or tells lively stories over drinks about the one that could have been.

Stage 11 - Post Mortem. Pros have forgot about the stock and are considering carpet samples for their new home in Florida. Average Investor continues to follow the company and buys loads of cheap stock to try and overcome the regrettable loss.

The stock market is mean. You can be a good analyst, but if you can't overcome the psychological traps of trading, you will do what the crowd does. To be successful, you have be one step ahead of the crowd, and trade with unemotional discipline. There are strategies to take advantage of each stage of the market cycle that can be applied just by looking at a stock chart. They just require a bit of knowledge.

----------------------------------

Everyday for the next 30 days, read this 10 times a day.Ask yourself 10 times a day "what kind of trader am I going to be??" Am I going to be a crying whining little bitch or am I going to shake it off?? Am I going to buy to high because I do not know how to read a chart or am I going to f**cking learn how to read a chart?? Am I going to be the entertainment for this board or am I going to go the library and check out all the books that I can read on day trading and investing and stock charting. Am I going to learn how to do my own due diligence or am I going to buy on the recommendation of people from this board?? (It is pretty obvious that is what happened) they were great recommendations but you were about 5 steps behind. It looks like by the time you were buying everyone else was selling. Am I going to take this laying down or am I going to get my Goddamn money back. No one can make those choices for you!!

May seem like I am being a cold hearted bitch but this the real world baby. The question you have to address right this minute is… am I going learn on the fly or am I going to back it up and learn about what the f**ck I am doing?? You dove in headfirst now you have to learn how to swim. If you are not willing to learn how to swim—bail and take your loss. Day trading is time consuming. I would venture to say that most of the people on this board spend 5 to 10 hours a day researching-charting-reading sec filings-going over financials—reading news releases—communicating with other traders on strategies—then finally buying—then the same process begins for the exit. It may not seem like it right now but I am trying to help you. As will others. Sugarcoating the facts will not help you. You need a good dose of reality and I just gave it to you!! I.e. reality incorporated....

The only consolation that I can give you is: I have been in your shoes. After over 20 years of dealing with the market I still was not prepared for the depth of day trading. I learn new things everyday and make mistakes everyday. After 4 years of making at least 5 trades a day I am a newbie just like you. It is a process. Welcome to day trading and good luck with your choices. Reality incorporated Establish a set of trading rules that work for you. These are my rules. You have a adapt your own. Maybe this will give you some guidelines to go by.

----------------------------------

MY PENNY STOCK RULES:1. I never buy on impulse or get emotionally attached to a

penny stock—think LOGIC—I buy it, I sell it, I make money and I rarely look back.

2. I never buy a stock JUST because I like it or worse someone else likes it.

3. I rarely buy a micro penny stock trading under a volume of 50,000 mil—80 to 100 mil is better (always remember there has to be buyer for every stock you buy)...

4. I rarely hold a micro penny stock over night.... My definition of micro penny is under .10 cents ...Rarely over a weekend...NOTICE I SAID RARELY. THERE ARE SOME STOCKS THAT HAVE A BUILD UP AND IF THE VOLUME IS GOOD AND I FEEL CONFIDENT ABOUT MY DD I WILL HOLD IT FOR THE RUN. At $7.00 to $10.00 a trade I can buy and sell it every day on news or hype or earning whatever. .(THAT'S WHY IT'S CALLED DAY TRADING)

5. I never buy a penny stock on the way up. IE CHASING I watch the pre market trading and set a buy price and a sell price and stick to it (missed out on NEOM by sticking to my rules—I noticed it at .11 and refused to buy to high) UPSIDE IS I DO NOT HOLD 500,000 SHARES OF NEOM AT.43 CENTS—-DOWNSIDE I DID NOT MAKE 50,000 DOLLARS. I DID MAKE A COUPLE OF GRAND BY PLAYING THE GAP AFTER THE RUN. IF YOU MISS THE RUN PLAY THE GAP. LIKE THE MAN SAID—THERE IS ANOTHER STOCK JUST WAITING TO BE BOUGHT.

6. I never think about GETTING RICH OR RETIRING on penny stocks...My goal is to make $200.00 a day and not lose my original investment. Most often I exceed my goal. (When I lose money it is usually because I have not followed my own rules)

7. I never ride a stock down—I will sell it and re-buy it. EXAMPLE: BOUGHT CTKH AT .002 AND .0022. SOLD HALF AT .0046. SOLD HALF OF THAT HALF AT .0069. IT STARTED GOING DOWN AND I BAILED OUT AT .006. BOUGHT AGAIN TODAY AT .0032. LOGIC-DO YOU ACTUALLY BELIEVE MUTUAL FUND MANAGERS WOULD HAVE HELD ONTO IBM IF IT DROPPED 50%?????—(WELL SOME WOULD) LOL I THINK NOT...RIDING A STOCK DOWN IS LIKE THROWING 50% OF YOUR MONEY OUT OF A CAR WINDOW AT 75 MILES AN HOUR AND HOPING IT FLIES BACK TO YOU. OR BETTER YET "IF YOU LOVE IT LET IT GO—IF IT LOVES YOU IT WILL COME BACK TO YOU". THAT’S BULL****—IF IT LOVED YOU IN THE FIRST PLACE IT NEVER WOULD HAVE LEFT... I have actually bought and sold the same stock 3 times in one day. ATNG WAS A RECENT 3 TIME BUY AND SELL. BOUGHT AND SOLD IBZT 3 TIMES ONE DAY. (not usually but it does happen).

8. I never insult or bash another fellow trader...I respect other people's trading methods. I LEARN FROM THEM. What the hell—It's not my money.... ( It's not like they are setting on third base at a black jack table and take a hit on 15 and the dealer has a 6 showing and I have $500.00 dollars riding on that hand). I DO LISTEN AND LEARN AND BENEFIT FROM THEM.

9. I never trade with MONEY that I am not willing to lose.

10. I follow the market and market trends (not just the stocks)

11. I never buy a stock without reviewing, analyzing and understanding the charts. I learned how to read charts and believe in them....They do not lie...I MAY NOT KNOW WHAT THEY MAKE OR PRODUCE OR SELL WHEN I BUY IT BUT I DO REVIEW THE CHARTS ON THE FLY AND PUT IN A BUY ORDER FOR SMALL AMOUNT TO GET IN THE DOOR. MOST TRADERS KNOW WHEN A RUN IS COMING AND HAVE ALREADY DONE THE DUE.

12. I never get gambling and investing confused. I INVEST IN REAL ESTATE.... MY BUSINESS....SMALL, MEDIUM AND LARGE CAP STOCKS WITH A HISTORY-MANAGEMENT TEAM-FINANCIALS—ASSETS—CASH—ETC...30 YEARS+ GROWTH AND INCOME MUTUAL FUNDS WITH 12% OVERALL GAIN IN GOOD AND BAD TIMES (THEY ARE PROFESSIONALS AND THAT IS THEIR JOB). I GAMBLE WITH PENNIES... MY DEFINITION OF PENNIES IS ANYTHING UNDER $5.00.

13. I always take 50% of earning from each week and e-transfer into INTEREST BEARING TAX account. THEN I LEARNED HOW TO INVEST THAT MONEY IN REAL ESTATE TO MINIMIZE TAXES. INCORPORATE, PROTECT AND SHELTER.

14. I ALWAYS TAKE MY ORIGINAL INVESTMENT OUT OF THE EQUATION WHEN IT IS FEASIBLE TO MAKE ENOUGH MONEY ON THE TRADE TO MAKE IT WORTHWHILE .IE...WHEN THE STOCK IS ON A RUN UP SELL PORTIONS AT TIME TO RECOUP ORIGINAL INVESTMENT. IF IT IS A STOCK I PLAN TO KEEP LIKE TFSM—I BOUGHT AT 1.06. AT 2.12 I WILL SELL HALF AND RECOUP INVESTMENT AND KEEP 5000 SHARES FOR FREE. HOPEFULLY THAT WILL BE THIS WEEK.

15. I ALWAYS HAVE FUN.........ACTUALLY I HAVE A BLAST....

16. I LEARN SOMETHING NEW EVERYDAY....

17. I CAN'T SPELL, TYPE WELL OR USE PROPER GRAMMAR—AND I SWEAR LIKE A SAILOR...BUT IF YOU PUT A DOLLAR SIGN IN FRONT OF IT—-I WILL FIGURE IT OUT..........THAT CERTAINLY DOES NOT MAKE ME STUPID...IT MAKES ME SMART BY RECOGNIZING MY LIMITATIONS. LEARN YOURS.

18. I ALWAYS MAKE MY OWN DECISIONS AND TAKE ALL RESPONSIBILITY FOR MY ACTIONS.

19. I LAUGH EVERYDAY...MOSTLY AT MYSELF AND SOMETIMES AT OTHERS....

20. LAST AND MOST IMPORTANT—THE MARKET HAS A RHYTHM—EACH STOCK HAS A RHYTHM—LIKE GREAT SEX—A RHYTHM...FIGURE OUT YOUR OWN RHYTHM WITH THE MARKET AND DUE YOUR OWN DD... LEARN THE RHYTHM OF THE CHARTS. IT IS CALLED "HARD WORK". THE REST WILL FOLLOW. TAKE THE TIME TO PASS ON YOUR GOOD FORTUNE TO OTHERS. WHAT GOES AROUND COMES AROUND AND YOU CAN TAKE THAT TO THE BANK.

-- realityinc21/Diana***

Some other reliable gurus I've run across at Allstocks.com’s Bulletin Board are

FatherOfTwo and

QuestSolver, but there are a lot of talented folks on this forum and on other sites online. No matter how highly or lowly rated anyone is, however, your best bet is to track their advice for a while -- and look at their old recommendations -- to see how often they're right and wrong.

Once you've found someone who can find the winners, also think about whether or not their advice and trading style fit your needs and your own style and attitude. This vetting process will help you figure out whose picks you should follow in the future, which in turn will speed up your own ability to make money on the fly. --

L.B.

I just stumbled across MonkStyle.net, the website of Aaron Booth, a Sydney, Australia-based web designer that was trained as an illustrator at Joe Kubert's renowned World of Cartooning (NYC). In addition to the expected ranting and comic book musings, his blog contains links to his eye-catching drawings and photographs.

I just stumbled across MonkStyle.net, the website of Aaron Booth, a Sydney, Australia-based web designer that was trained as an illustrator at Joe Kubert's renowned World of Cartooning (NYC). In addition to the expected ranting and comic book musings, his blog contains links to his eye-catching drawings and photographs.

As recently hyped by Wired magazine, Star Trek: New Voyages will be releasing a new Star Trek episode soon. This one staring Walter Koenig, the original Lt. Pavel Chekov. It's amateur fan-boy TV-show freak-out time, as the New Voyage kids finally have one of the real Star Trek actors acting alongside their hazy facsimile versions of Kirk, Spock, and crew.

As recently hyped by Wired magazine, Star Trek: New Voyages will be releasing a new Star Trek episode soon. This one staring Walter Koenig, the original Lt. Pavel Chekov. It's amateur fan-boy TV-show freak-out time, as the New Voyage kids finally have one of the real Star Trek actors acting alongside their hazy facsimile versions of Kirk, Spock, and crew.

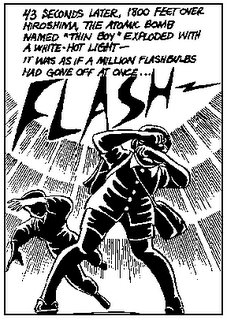

However, Rick Veitch's Maximortal and Brat Pack graphic novels (the first two volumes of the as yet uncompleted King Hell Heroica five-part series) were not as mesmerizing as I'd hoped. Interesting, provocative, gross-out funny, and weird, yes. But not the best revisionist superhero epic in the galaxy (Veitch has had his hand in quite a few classics over the years, notably as an artist, but his solo works never quite reach the pinnacle of such superhero reimaginings as Planetary, the Invisibles, Watchmen, X-Statix, Miracle Man, Sandman, the best of Frank Miller and Alan Moore, even such oddities as American Flagg, Nexus, Zot!, Madman, Concrete, etcetera, etcetera). Brat Pack does offer lush black-white-and-grey artwork, the creepiest interpretation of Batman & Robin you'll ever read, the iconic/archetypal Doctor Blasphemy (one of the most memorable-looking comic creations ever), and the catchy tagline, "Live fast, love hard, die with your mask on."

However, Rick Veitch's Maximortal and Brat Pack graphic novels (the first two volumes of the as yet uncompleted King Hell Heroica five-part series) were not as mesmerizing as I'd hoped. Interesting, provocative, gross-out funny, and weird, yes. But not the best revisionist superhero epic in the galaxy (Veitch has had his hand in quite a few classics over the years, notably as an artist, but his solo works never quite reach the pinnacle of such superhero reimaginings as Planetary, the Invisibles, Watchmen, X-Statix, Miracle Man, Sandman, the best of Frank Miller and Alan Moore, even such oddities as American Flagg, Nexus, Zot!, Madman, Concrete, etcetera, etcetera). Brat Pack does offer lush black-white-and-grey artwork, the creepiest interpretation of Batman & Robin you'll ever read, the iconic/archetypal Doctor Blasphemy (one of the most memorable-looking comic creations ever), and the catchy tagline, "Live fast, love hard, die with your mask on."